Facing tax season? J.K. Lasser's Your Income Tax 2025 is your trusted guide to navigating the 2024 tax return. This #1 best-selling series provides clear, concise instructions and up-to-date information on the latest tax laws and regulations. Learn how to maximize deductions and credits, understand recent court decisions and IRS rulings, and utilize helpful worksheets and forms. With simple tips and proven strategies, this book empowers you to confidently file your taxes and keep more of your hard-earned money. Trusted for over 80 years, J.K. Lasser's Your Income Tax 2025 simplifies the process, making tax preparation a breeze.

Review J.K. Lasser's Your Income Tax 2025

Okay, let's talk about J.K. Lasser's Your Income Tax 2025. This isn't exactly a beach read, let's be honest. We're talking 894 pages of densely packed information – a hefty tome that feels more like a reference manual than a casual read. But that's precisely what makes it so valuable, and why I wouldn't hesitate to give it a five-star rating.

The sheer scale of the book reflects the complexity of the US tax code itself. It's a daunting beast, and the idea of tackling the actual code directly feels about as appealing as a root canal without anesthesia. This book, however, acts as a supremely helpful guide through that bewildering maze. It's a distilled version, a manageable chunk of that monstrous whole, focusing on the practical aspects most people need to know.

One might initially feel overwhelmed by the sheer volume of information, but that's a testament to its comprehensiveness. The authors haven't shied away from the details; they've laid everything out clearly and methodically. The book walks you through the process step-by-step, explaining the various forms, credits, and deductions in plain language. While it demands attention and effort, it's not written in confusing legalese. It's designed for everyday people, not tax lawyers.

I appreciate the practical approach. It's not just about providing the information; it's about guiding you through how to use it effectively. The inclusion of worksheets and forms is a fantastic addition, simplifying the task of organizing your financial information and preparing your return. The book also effectively summarizes important recent tax court decisions and IRS rulings, ensuring that you're up-to-date on the latest interpretations of the law. It's clear the authors put significant effort into keeping everything current and relevant for the tax year.

Now, let's be realistic: this isn't a book you’ll enjoy reading cover-to-cover. It's a resource, a tool, something you’ll likely consult repeatedly as needed. It's the kind of book that sits on your desk, a steadfast companion during tax season, providing answers to your burning questions and helping you navigate the complexities of filing your return. It’s the kind of book that justifies its cost many times over in the potential savings it can help you achieve through informed tax planning.

Some reviews mention typos, and while I haven't personally encountered any, it underscores the potential for small errors in such a large publication. However, in the grand scheme of things, these are minor issues compared to the overall value and usefulness the book provides. The quality of the paper, as one reviewer noted, is indeed a welcome touch – a small but appreciated detail in a book that will likely see a lot of use.

Overall, J.K. Lasser's Your Income Tax 2025 is a reliable and indispensable resource for anyone navigating the annual tax season. It's not exciting, but it’s effective. It’s a book you'll appreciate for its practicality, its clear explanations, and its role in helping you successfully complete a potentially stressful process. If you're serious about understanding and managing your taxes, this book is an investment worth making.

Information

- Dimensions: 8.5 x 1.7 x 10.8 inches

- Language: English

- Print length: 928

- Publication date: 2024

- Publisher: Wiley

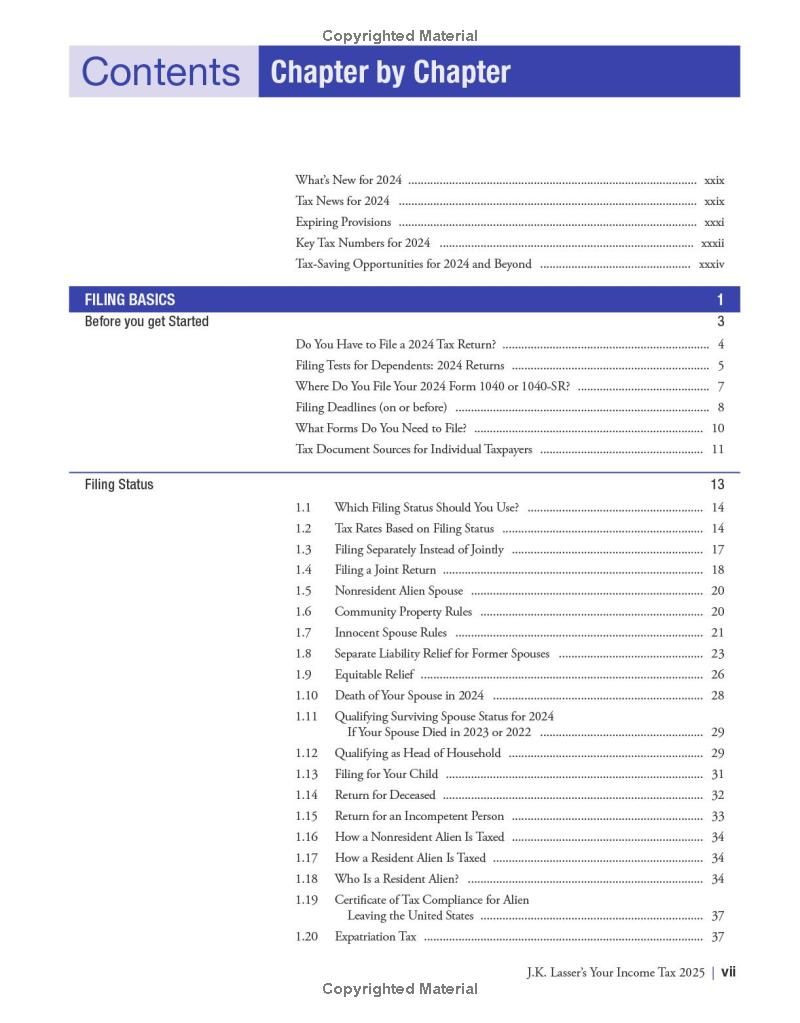

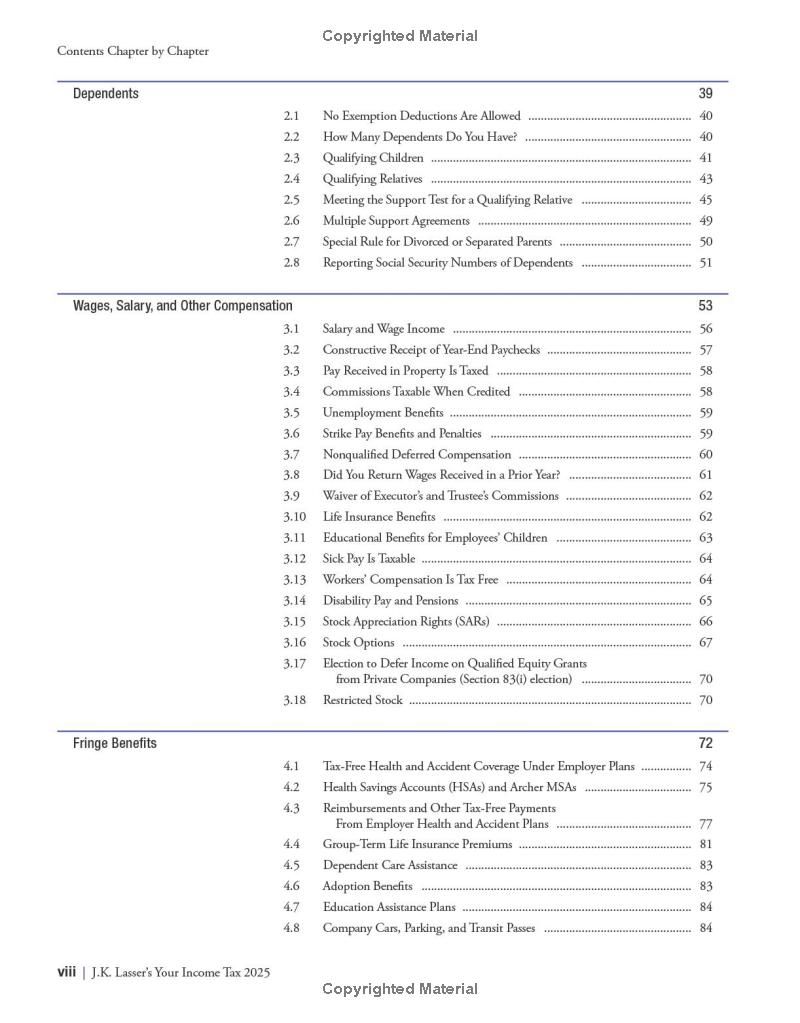

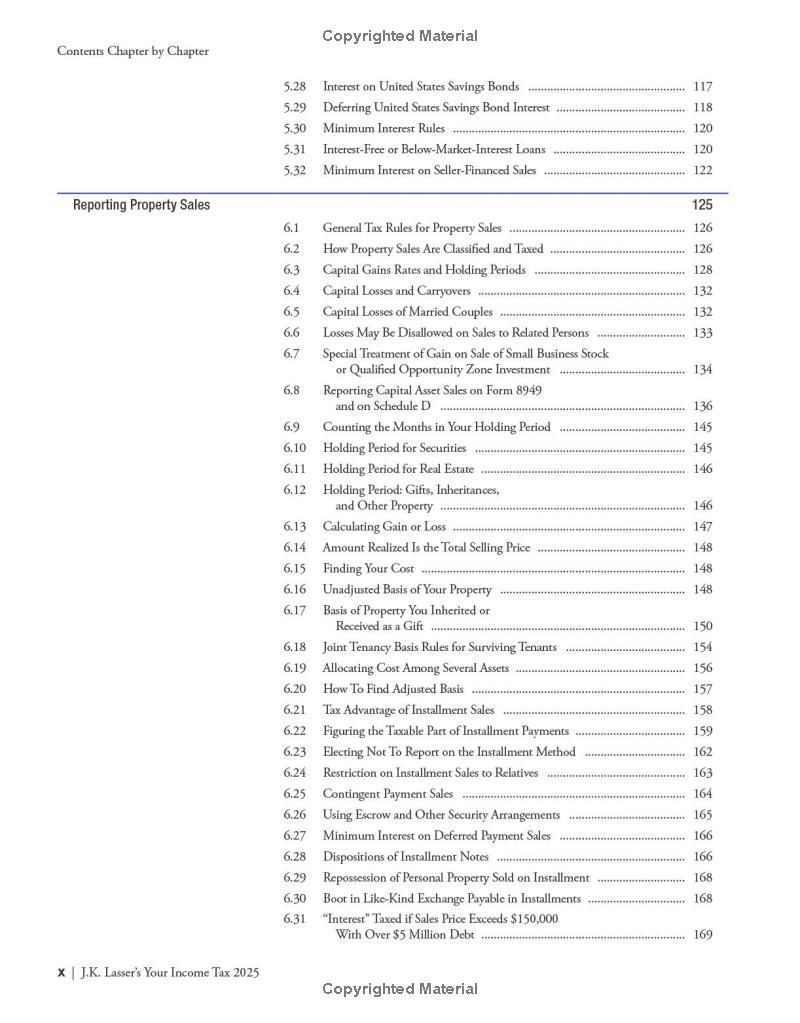

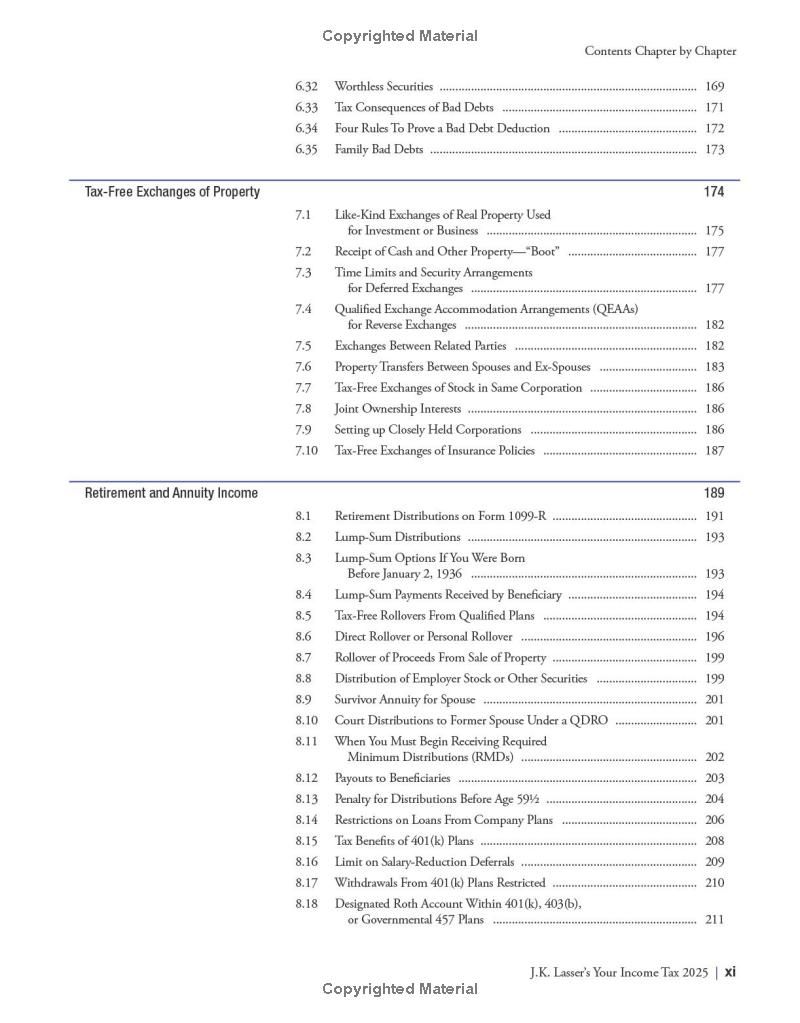

Book table of contents

- Reporting Property Sales

- General Tax Rules for Property Sales

- How Property Are Classified and Taxed

- Cpital Gains Rates and Holding Periods

- Cpital Losses of Marticd Couples

- Losses May Be Disallowed on Sales Related Persons

- Spccial Trcarmcnr of Gain Sale of Small Business Srock

- Qualified Opporruniry Zone Invesrmenr

- Reporring Capỉtal Sales Torm 8949 and on Schedule D

- Counting the Months in Your Holding Period

- Holding Period for Securities

- Holding Period for Real Estate

- Holding Period: Gifis, Inheritances, Orher Property

- Calcularing Gain Loss

- Amounr Rellized Is che Toral Selling Pricc

Preview Book